- Blog

- DTC

The Rise Of Sober Curious Products, Explained

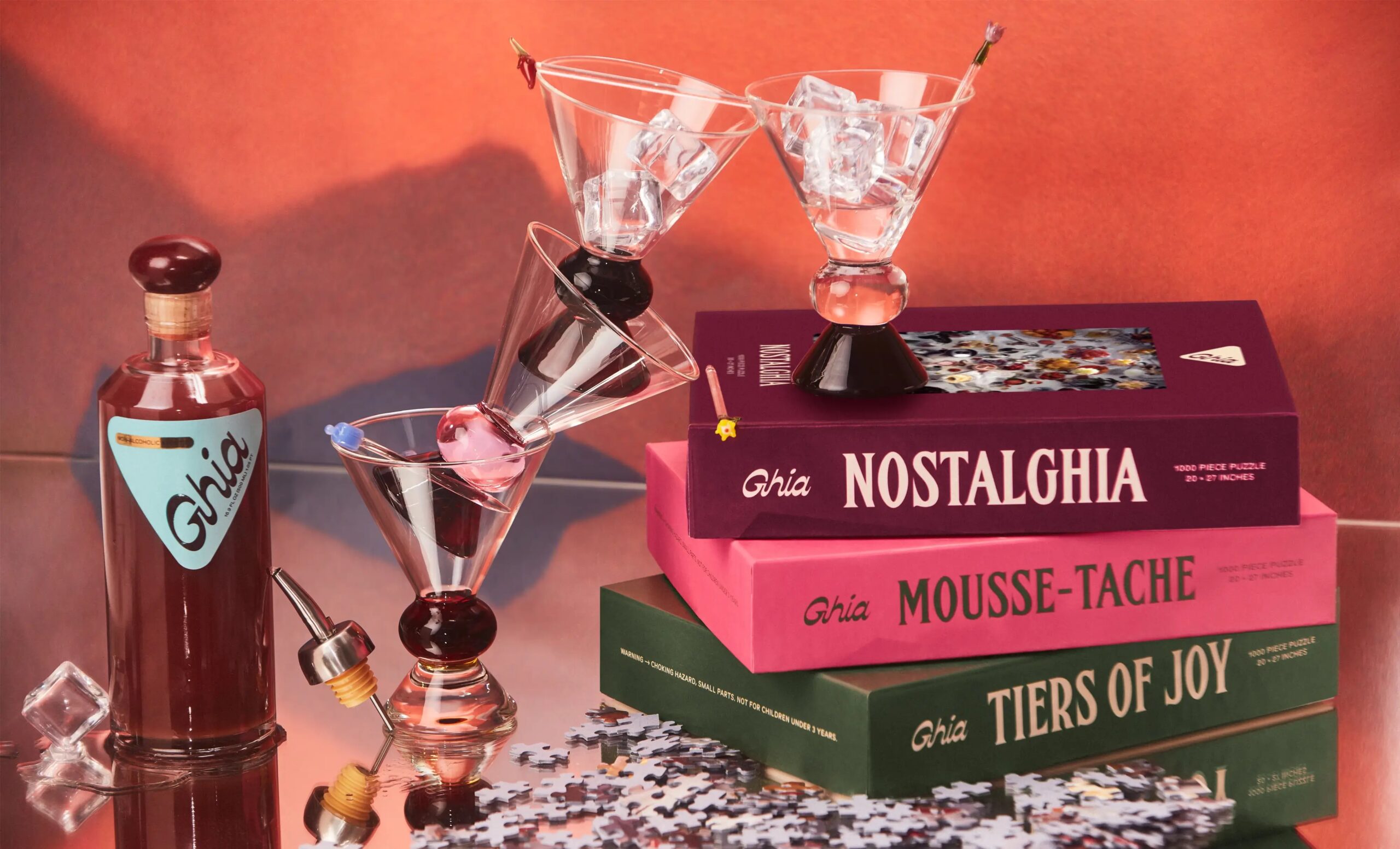

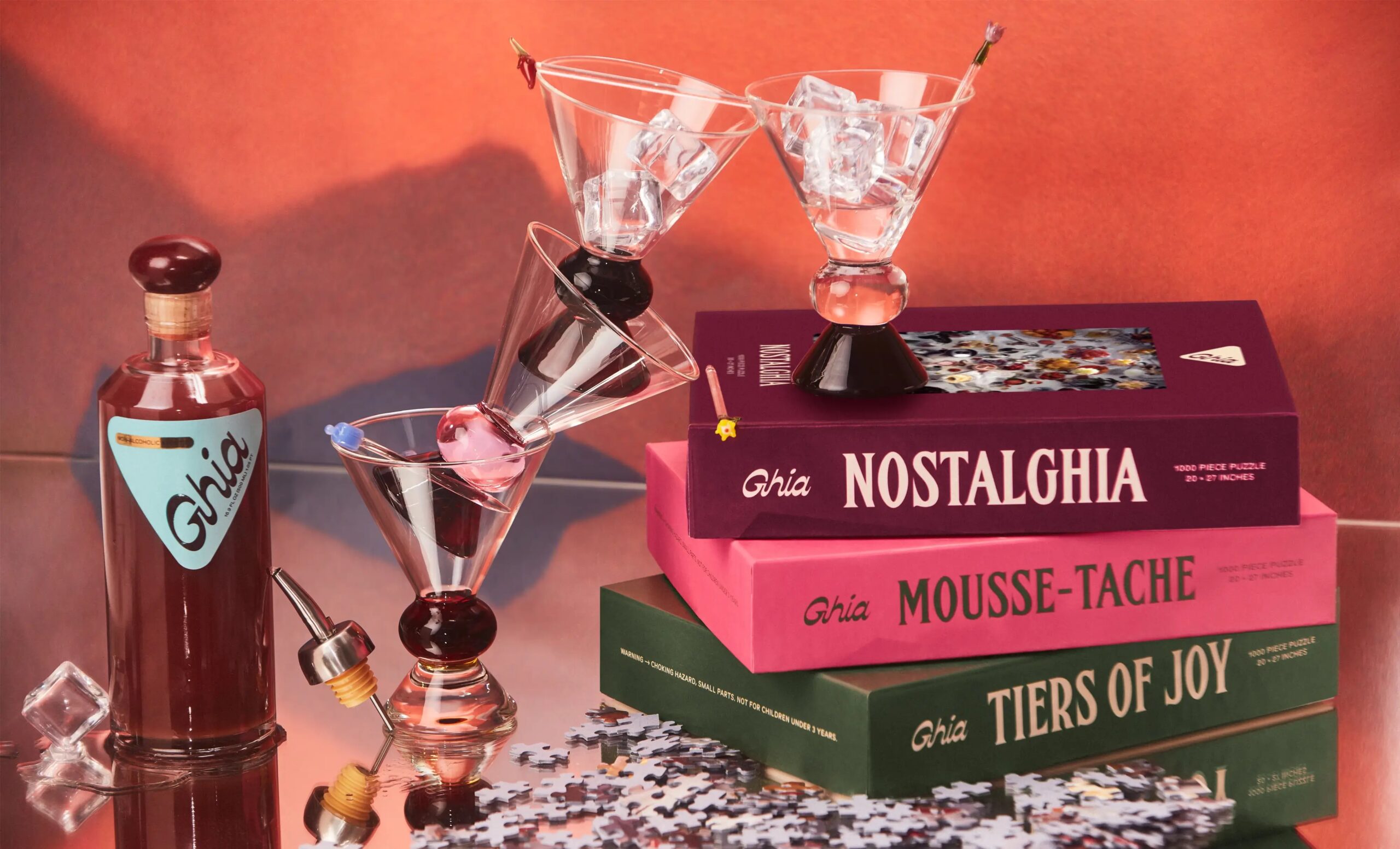

Have you met Glossier alum Melanie Masarin? A few years back, Melanie decided drinking wasn’t for her. But she still wanted to participate in the activities that alcohol was often associated with.

Since ~2014, this has been a growing sentiment among Millenials and GenZ, who drink less than previous generations. The only difference? Melanie founded Ghia, a non-alcoholic aperitif brand, to make exploring sober curiosity easier.

Sure, in the beginning, sober curiosity was just a wellness buzzword. But by Ghia’s launch in 2020, it was officially a full movement. The year prior, 21% of American drinkers participated in Dry January, with millennials leading the charge.

But sober curiosity catching on shouldn’t have been all that surprising. In 2018, adult beverage sales were slowing due to “shifting demographics, stagnant wages, health and wellness trends, fewer drink-led occasions, and declining big brands,” per Nielsen. And over 50% of US adults were trying to reduce their alcohol intake at that time.

What is surprising is that the DTC trend is no longer fueled exclusively by wellness.

Sober-curious products have become increasingly popular worldwide, especially in areas with stricter alcohol restrictions. That’s because non-alcoholic offerings often have fewer restrictions and are cheaper to produce, making them more accessible.

The results? A range of sober-friendly drinks that can pass as alcohol at social gatherings. Liquid Death (water masquerading as a tall boy), Seedlip (a non-alcoholic spirit brand), and Heineken 0.0 (the big brewery’s non-alcoholic beer) come to mind. All of which have seen exponential growth recently.

Source:

WSJ

Source:

WSJ

Liquid Death is now valued at $700m after launching in 2019. Seedlip is available in 7,500+ locations worldwide. And Heineken is hoping its non-alcoholic offerings will make up 5% of its US portfolio by 2023 (they only introduced these products to Americans this January).

Currently, inflation is taking another hit on alcohol sales, per Attest:

But non-alcoholic beer sales, in particular, are staying the course. Sales for these products have climbed 90% over the past decade (outpacing the traditional beer market).

And even with inflation, they’re still projected to grow at an 8% rate over the next 5 years (the global market will surpass $25b by 2024). Again, proving that folks might give up the sauce, but they’re not willing to forgo the social scene that comes with it.